Singularity Tomorrow

on predictions

Preamble

Humans are terrible at predicting accelerating future. Our brains are designed for short-term survival, not long-term planning. We struggle to understand exponential growth, our predictions are easily swayed by framing, and even when we're right, our predictions are still too small and biased to be useful.

Prediction markets solve this, but they don't solve a deep underestimation of human potential. They fail to account for the unpredictable nature of human behavior and the transformative power of human agency.

State less predictions, make more bets, and harness your agency.

You're bad at making predictions

Human brains are not naturally equipped for accurate time predictions. We evolved in an environment where making predictions about the immediate future was the only essential for survival, with the vast timescales and rapid changes that are needed for proper forecasting being beyond the scope of our natural cognitive processes.

Our brains are capable of understanding linear growth but falter when confronted with exponential graphs, often leading to underestimations of its impact. The innate inclination to seek linear patterns in the world and limited working memory further impedes our understanding of exponentials.

Your prediction changes, depending on how I ask

When human researchers were asked questions in "fixed-probability" framing, as in, "by which year an event has an p% cumulative probability (for p=10%, 50%, 90%)", their answers would produce a systematically earlier prediction, compared to "fixed-years" framing, as in "what is the cumulative probability of the event by year y (for y=10, 25, 50)." (Grace et al., 2018a, 2022).

One might argue that the impact of framing bias is insignificant, suggesting that it can be mitigated by simply asking two groups of respondents different questions and averaging their responses.

I object that pervasiveness of framing bias is much more profound.

Let's ask researchers to provide their predictions for the likelihood of two distinct events: the arrival of full automation of labor (FAOL) and the achievement of human-level machine intelligence (HLMI). While FAOL refers to the automation of all occupations, HLMI pertains to the feasibility of automating all tasks. Since occupations can be viewed as complex tasks, composed of tasks, or closely related to tasks, achieving HLMI would seem to imply either having already achieved FAOL or being relatively close.

Despite this logical connection, human researchers consistently predict a 50% chance of FAOL occurring more than 60 years later than a 50% chance of HLMI emerging. (Grace et al., 2024).

You're biased. Limited by the amount of information you can possibly consume, you remain biased.

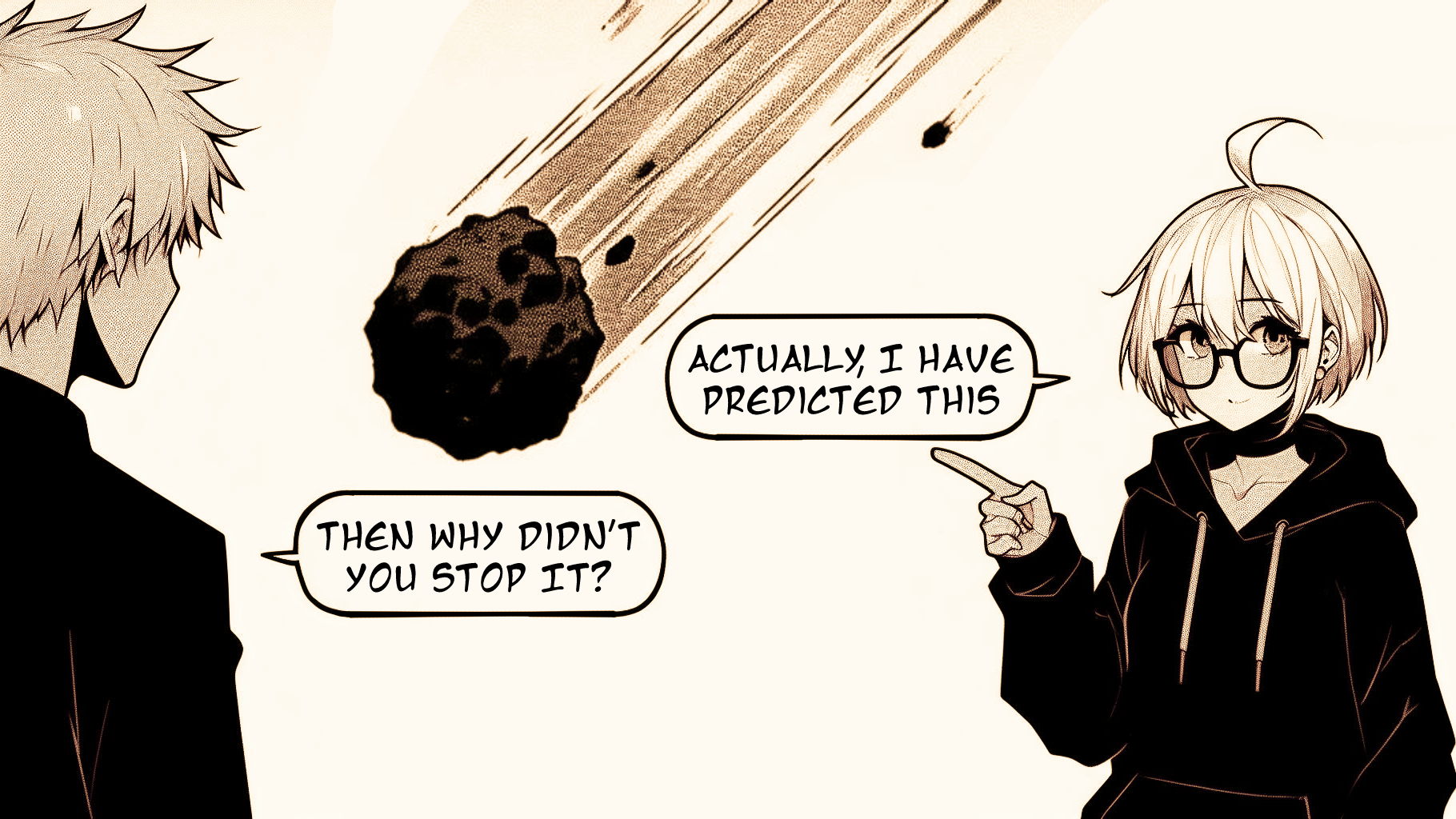

Even when your prediction is right, it's still useless

A single observation is simply too small and too susceptible to random variation to draw meaningful conclusions from.

As a result, when you listen to one prediction over another, you are essentially choosing whose biases you prefer more. On top of that, a sample size of 1 is not enough to capture full complexity of any issue. This is why relying on individual opinions is ultimately useless.

Individual predictions are also often flawed due to their susceptibility to egotism and wishful thinking. In the pursuit of appearing knowledgeable or influential, individuals tailor their predictions to align with their personal beliefs, rather than objectively assessing the likelihood of outcomes.

Prediction markets are nice, actually

Prediction markets, unlike traditional expert opinions or polls, offer a more reliable approach by aggregating information from a diverse group of participants and facilitating a self-correcting process.

Prediction markets are more objective because they are not based on individual egos. They are more accurate because they aggregate the knowledge of many people. They are also more adaptable, because they can change as new information comes in.

The notion of "everything being priced in" from the traditional markets, has a more positive connotation here. As information flows into the market, prices adjust accordingly, reflecting the collective wisdom of traders and giving you a nice assessment of future probabilities.

Best predictions don't make best plans

Predictions, no matter how sophisticated, are inherently limited by their reliance on historical data and current trends. They fail to account for the unpredictable nature of human behavior, and the significance of human agency.

I find it quite remarkable how few people grasp the true potential of humanity's efficiency and how distant we are from reaching it. I would argue that one of the most noble goals of humanity is to push the boundaries of efficiency, by harnessing individual's agency.

By placing too much emphasis on predictions, we risk stifling creativity, innovation, and our ability to adapt to changing circumstances.

Shall we state less predictions, make more bets, and harness agency? And if so, overcoming biases starts should start with destroying your ego.

When somebody complains, "It will take us years to reach the next frontier!", You must boldly predict: "Singularity tomorrow! Dyson sphere by friday!"